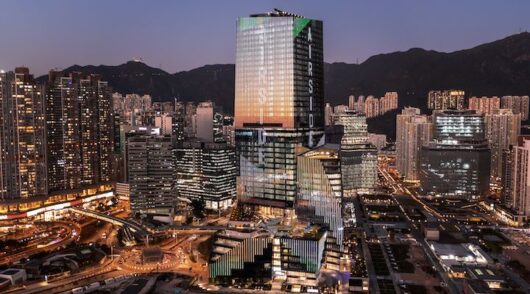

Hong Kong

Nitori ramps up Asia expansion, enters Hong Kong this month

The launch is part of the brand's strategy to accelerate its growth in Asia.

Get the latest from Inside Retail straight to your inbox.